In the realm of small business operations, the importance of top-rated safety insurance cannot be overstated. This essential component ensures protection against unforeseen circumstances and safeguards the future of businesses. Let's delve deeper into the world of safety insurance tailored for small businesses, exploring the various options and benefits it offers.

Types of Top-rated Safety Insurance

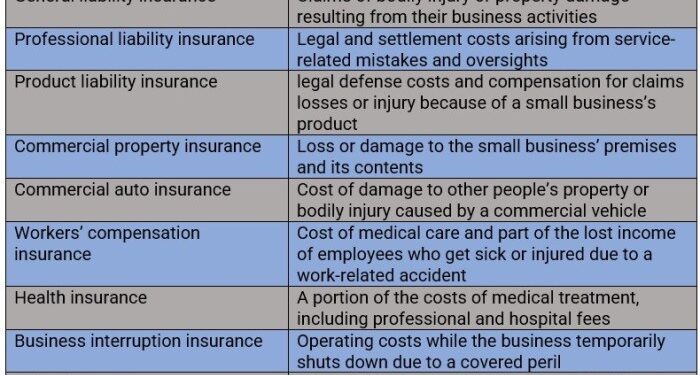

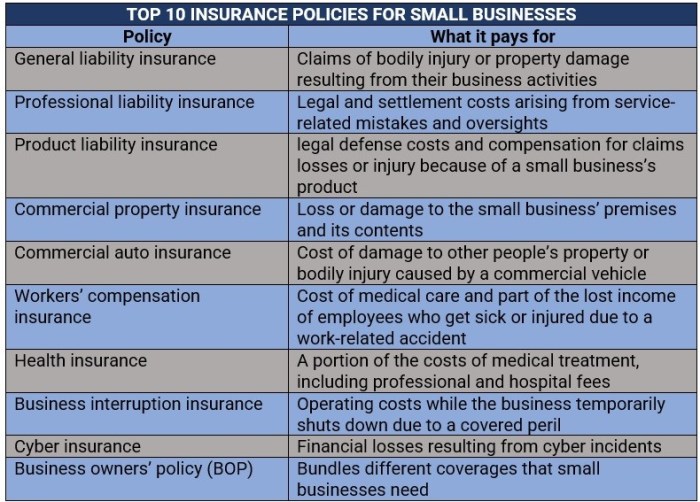

Insurance is essential for small businesses to protect themselves from potential risks and liabilities. There are various types of safety insurance options available tailored to different industries and business needs.Choosing the right type of insurance coverage is crucial to ensure adequate protection.

Here are some examples of insurance plans tailored for different industries:

General Liability Insurance

General liability insurance provides coverage for third-party bodily injury, property damage, and advertising injury claims. It is essential for businesses that interact with customers or clients on their premises.

Workers' Compensation Insurance

Workers' compensation insurance covers medical expenses and lost wages for employees injured on the job. It is mandatory in most states for businesses with employees.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects businesses against claims of negligence or inadequate work. It is crucial for service-based industries like consultants, lawyers, and accountants.

Property Insurance

Property insurance covers damage to a business's physical assets, including buildings, equipment, and inventory. It is vital for businesses with a physical location.

Cyber Liability Insurance

Cyber liability insurance protects businesses from data breaches and cyberattacks. It covers expenses related to data recovery, notification costs, and legal fees. It is essential for businesses that store sensitive customer information.Choosing the right type of safety insurance for your small business can make a significant difference in mitigating risks and ensuring financial stability in case of unexpected events.

Factors to Consider When Choosing Safety Insurance

When selecting a safety insurance provider for your small business, there are several key factors to consider to ensure you get the right coverage that meets your needs. It's important to compare and contrast different insurance policies in terms of coverage, premiums, and deductibles.

Additionally, evaluating the financial stability and reputation of insurance companies can help you make an informed decision.

Coverage

- Review the types of coverage offered by each insurance provider and ensure they align with the specific risks your business faces.

- Consider additional endorsements or riders that may be available to customize your policy to better suit your business needs.

- Check for any exclusions or limitations in the policy that may leave your business vulnerable in certain situations.

Premiums and Deductibles

- Compare premium rates from different insurance companies to find a balance between affordability and sufficient coverage.

- Understand how deductibles work and choose a deductible amount that you can comfortably afford in the event of a claim.

- Consider the impact of deductibles on your premium rates and weigh the pros and cons of higher or lower deductibles.

Financial Stability and Reputation

- Research the financial stability of insurance companies by checking their credit ratings from agencies like A.M. Best or Standard & Poor's.

- Look up customer reviews and ratings to gauge the reputation of insurance companies in terms of customer service and claims processing.

- Consider the longevity and track record of insurance companies in the industry to ensure they will be reliable partners for your business.

Benefits of Top-rated Safety Insurance

Having top-rated safety insurance for small businesses comes with a range of advantages, providing essential protection and peace of mind in various situations.

Protection Against Financial Loss

- Insurance coverage can help small businesses recover financially in the event of property damage, theft, or other unforeseen circumstances.

- For example, a small retail store that experiences a break-in can rely on insurance to cover the cost of stolen inventory and repairs, preventing a significant financial setback.

Liability Coverage

- Top-rated safety insurance includes liability coverage, protecting small businesses from legal claims and lawsuits.

- In a scenario where a customer slips and falls in a small business establishment, insurance can help cover medical expenses and legal fees, preventing the business from facing a substantial financial burden.

Business Continuity

- In the event of a natural disaster or unexpected event that disrupts business operations, insurance can help small businesses stay afloat by covering expenses like rent, payroll, and utilities.

- For instance, a small restaurant that suffers fire damage can rely on insurance to cover the cost of repairs and maintain financial stability during the recovery period.

How to Find the Best Safety Insurance Provider

Finding the best safety insurance provider for your small business is crucial to ensure adequate protection. Here are some steps to help you in your search:

Research and Identify Top-Rated Providers

- Start by researching top-rated safety insurance providers that specifically cater to small businesses. Look for companies with a strong reputation for customer service and claims processing.

- Utilize online resources such as insurance comparison websites to compare different insurance options available for small businesses. These platforms can help you understand the coverage offered by various providers.

- Consider reaching out to industry associations or trade groups for recommendations on safety insurance providers that are well-regarded within your specific business sector.

Read Reviews and Seek Recommendations

- Reading reviews and testimonials from other small business owners can provide valuable insights into the experiences they have had with different safety insurance providers. Look for feedback on the ease of filing claims, responsiveness of customer service, and overall satisfaction with the coverage.

- Seek recommendations from colleagues or business partners who have firsthand experience with safety insurance providers. Personal recommendations can often help you narrow down your options and make a more informed decision.

- Don't hesitate to ask potential insurance providers for references from other small businesses they have worked with. Speaking directly to existing clients can give you a better understanding of what to expect in terms of service and coverage.

Conclusive Thoughts

As we wrap up our discussion on top-rated safety insurance for small businesses, it becomes clear that investing in the right insurance coverage is a strategic move for long-term success. By understanding the nuances of safety insurance and its impact on business stability, small business owners can confidently navigate the path to growth and resilience.

FAQ Explained

What are the key factors to consider when choosing safety insurance for small businesses?

Small business owners should consider factors such as coverage adequacy, premium affordability, and the reputation of the insurance provider.

How can insurance help mitigate risks for small businesses?

Insurance plays a crucial role in protecting assets and providing financial support in the face of accidents or legal challenges, reducing the impact of unexpected events on business operations.

Where can small business owners find resources to compare insurance options?

Platforms like insurance comparison websites or industry-specific forums can be valuable resources for small business owners looking to evaluate different insurance policies.