When it comes to safeguarding your well-being on the road, having the best car insurance with medical coverage is paramount. This comprehensive guide delves into the intricacies of medical coverage in car insurance, shedding light on its importance and benefits in various scenarios.

Exploring the nuances of different types of medical coverage, factors to consider when selecting the best policy, and cost analysis, this guide equips you with the knowledge needed to make informed decisions about your insurance coverage.

Overview of Car Insurance with Medical Coverage

Car insurance with medical coverage is a type of auto insurance policy that includes coverage for medical expenses resulting from a car accident. This coverage helps pay for medical bills, hospital stays, and other healthcare costs for you and your passengers in the event of an accident.

Examples of Situations Where Medical Coverage is Essential

- Severe injuries requiring hospitalization

- Costly medical treatments like surgeries or rehabilitation

- Extended recovery periods leading to loss of income

Importance of Having Medical Coverage in Car Insurance Policies

Having medical coverage in your car insurance policy is crucial as it provides financial protection in case of injuries sustained in a car accident. Medical expenses can quickly add up, and having coverage can help alleviate the financial burden on you and your loved ones.

Benefits of Having Medical Coverage in Car Insurance

Having medical coverage in your car insurance policy can provide numerous advantages and peace of mind in case of accidents or injuries while driving.

Financial Protection

- Medical coverage can help cover the costs of medical treatment for you and your passengers in the event of an accident, reducing the financial burden on you.

- Without medical coverage, you may have to pay out-of-pocket for medical expenses, which can be costly and add stress during already difficult times.

Legal Compliance

- Some states require drivers to have a minimum amount of medical coverage in their car insurance policies to comply with legal regulations.

- Having medical coverage ensures you meet the legal requirements and avoid potential penalties or fines for not having adequate insurance.

Peace of Mind

- Knowing that you and your passengers are covered in case of injuries can provide peace of mind while driving, allowing you to focus on the road without worrying about potential medical expenses.

- In contrast, not having medical coverage can lead to uncertainty and anxiety about how to handle medical bills if an accident occurs.

Real-Life Scenarios

- In a car accident where multiple passengers were injured, having medical coverage helped cover their hospital expenses, avoiding financial strain on the driver and passengers.

- Conversely, in a similar accident without medical coverage, the driver had to bear the full cost of medical treatment for themselves and their passengers, leading to significant financial hardship.

Types of Medical Coverage in Car Insurance

When it comes to car insurance policies, there are various types of medical coverage that offer protection in case of injuries sustained in an accident. Understanding the different options available can help policyholders make informed decisions to ensure they have the coverage they need.

Medical Payments Coverage

Medical payments coverage, also known as MedPay, is designed to cover medical expenses for the policyholder and passengers in the insured vehicle, regardless of who is at fault in the accident. This type of coverage typically has limits ranging from $1,000 to $10,000, and can help with medical bills, ambulance fees, and even funeral costs in the event of a fatal accident.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a broader form of medical coverage that not only pays for medical expenses but also covers lost wages and other related costs resulting from injuries sustained in a car accident. PIP coverage is mandatory in some states and provides more extensive protection compared to MedPay.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage includes medical coverage for injuries sustained in an accident caused by a driver who does not have insurance or does not have enough insurance to cover the full extent of the damages. This type of coverage can help pay for medical treatment and other expenses when the at-fault driver is unable to do so.

Bodily Injury Liability Coverage

Bodily Injury Liability Coverage is not a medical coverage for the policyholder themselves, but rather covers medical expenses for other parties involved in an accident where the policyholder is deemed at fault. This coverage is essential for protecting assets and ensuring that injured parties receive the necessary medical care.

Examples of Benefits

- Medical Payments Coverage can help cover immediate medical expenses for the policyholder and passengers, providing peace of mind in case of an accident.

- Personal Injury Protection offers more extensive coverage, including lost wages and other financial losses, to help policyholders recover from injuries without worrying about the financial burden.

- Uninsured/Underinsured Motorist Coverage ensures that policyholders are protected even when involved in an accident with an uninsured or underinsured driver, preventing out-of-pocket expenses for medical treatment.

- Bodily Injury Liability Coverage protects policyholders from potentially devastating lawsuits and financial repercussions by covering medical expenses for others involved in an at-fault accident.

Factors to Consider When Choosing the Best Car Insurance with Medical Coverage

When selecting car insurance with medical coverage, there are several key factors that individuals should take into consideration to ensure they are getting the best coverage for their needs.

Personal Health History and Lifestyle Choices

One important factor to consider is your personal health history and lifestyle choices. If you have pre-existing medical conditions or engage in high-risk activities that could result in injuries, you may need more comprehensive medical coverage. It's essential to assess your health risks and choose a policy that adequately covers any potential medical expenses.

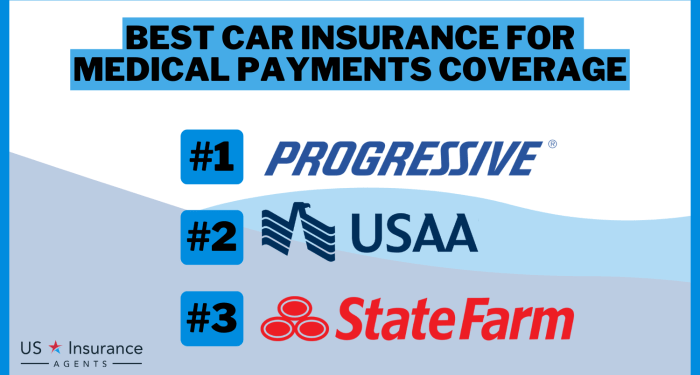

Comparison of Insurance Providers

Another crucial factor is to compare different insurance providers offering medical coverage and their unique features. Look for insurers with a good reputation for customer service, a wide network of healthcare providers, and a history of processing claims efficiently. Consider the cost of premiums, deductibles, and co-payments, as well as any limits on coverage or exclusions for pre-existing conditions.

Cost Analysis of Car Insurance with Medical Coverage

Adding medical coverage to a car insurance policy can significantly impact the overall cost. Let's break down the costs associated with this type of coverage and explore ways to find affordable options.

Premiums, Deductibles, and Coverage Limits

When it comes to car insurance with medical coverage, premiums are the regular payments you make to keep your policy active. Deductibles refer to the amount you must pay out of pocket before your insurance kicks in. Coverage limits, on the other hand, determine the maximum amount your insurance will pay for medical expenses.

- Premiums: Insurance companies consider various factors when calculating premiums, including your driving record, age, location, and the level of coverage you choose. Opting for higher coverage limits or adding additional features like roadside assistance can increase your premiums.

- Deductibles: Choosing a higher deductible can lower your premiums but will require you to pay more out of pocket in the event of a claim. On the other hand, a lower deductible means higher premiums but less financial burden when filing a claim.

- Coverage Limits: The higher the coverage limits, the more protection you have in case of a severe accident. However, this also means higher premiums. It's essential to strike a balance between adequate coverage and affordability.

Tips for Finding Affordable Car Insurance with Comprehensive Medical Coverage

Finding affordable car insurance with medical coverage requires careful consideration and comparison of quotes from different providers.

- Shop around: Obtain quotes from multiple insurance companies to compare prices and coverage options.

- Bundle policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance, to qualify for discounts.

- Choose a higher deductible: If you can afford to pay a higher deductible out of pocket, opting for one can lower your premiums.

- Drive safely: Maintaining a clean driving record can help you qualify for lower insurance rates.

- Ask about discounts: Inquire about any available discounts, such as those for safe driving habits, anti-theft devices, or completing a defensive driving course.

Final Review

In conclusion, securing the best car insurance with medical coverage not only offers peace of mind but also ensures that you are prepared for unforeseen circumstances. By understanding the nuances of medical coverage and choosing a policy tailored to your needs, you can drive with confidence knowing that you are well-protected on the road.

Q&A

What does car insurance with medical coverage entail?

Car insurance with medical coverage provides financial protection for medical expenses resulting from a car accident, including injuries sustained by you and your passengers.

How do personal health history and lifestyle choices impact the choice of medical coverage?

Personal health history and lifestyle choices can influence the type and extent of medical coverage needed in a car insurance policy. For example, pre-existing conditions may require higher coverage limits.

What factors should individuals consider when selecting car insurance with medical coverage?

Key factors to consider include coverage limits, options for medical treatment, network of healthcare providers, and the overall cost of the policy.

How do premiums, deductibles, and coverage limits affect the cost of car insurance with medical coverage?

Premiums, deductibles, and coverage limits play a significant role in determining the cost of car insurance with medical coverage. Higher coverage limits and lower deductibles typically result in higher premiums.

Where can I find affordable car insurance with comprehensive medical coverage?

Researching and comparing quotes from different insurance providers is a good way to find affordable car insurance with comprehensive medical coverage. Additionally, exploring discounts and bundling options may help lower the overall cost.