When it comes to traveling, ensuring you have the best travel insurance with health coverage is paramount. Not only does it provide peace of mind, but it also offers crucial protection in case of unexpected medical issues while abroad. Let's delve into the world of travel insurance and understand why having adequate health coverage is essential for every traveler.

Importance of Health Coverage in Travel Insurance

Travel insurance with health coverage is essential for travelers as it provides protection in case of unexpected medical emergencies while abroad. Having adequate health coverage can make a significant difference in the quality of care received and the financial burden on the traveler.

Significance of Health Coverage

- Health coverage ensures access to medical treatment in foreign countries where healthcare costs can be high.

- It provides peace of mind knowing that you are financially protected in case of illness or injury during your trip.

- Without health coverage, travelers may face exorbitant medical bills that can lead to financial strain or even bankruptcy.

Comparison of Policies

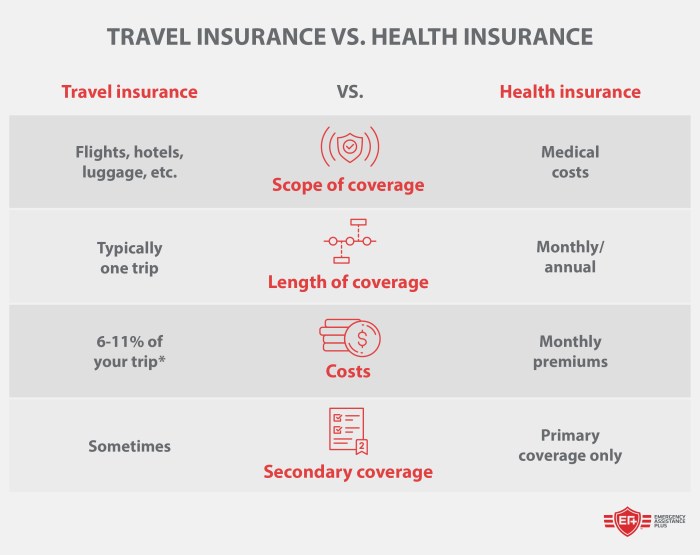

- Travel insurance policies without health coverage may be cheaper, but they leave travelers vulnerable to high medical expenses.

- Policies with health coverage may have higher premiums, but they offer comprehensive protection and coverage for medical emergencies.

- It is crucial for travelers to carefully review and compare the health coverage included in different travel insurance policies to ensure they are adequately protected.

Factors to Consider When Choosing the Best Travel Insurance with Health Coverage

When selecting travel insurance with health coverage, there are several key factors to consider to ensure you have the right protection for your trip.

Coverage Limits, Deductibles, and Exclusions

The coverage limits, deductibles, and exclusions of a travel insurance policy play a crucial role in determining the overall quality of the insurance. Coverage limits refer to the maximum amount the insurance will pay for covered expenses. It is essential to choose a policy with adequate coverage limits to ensure you are protected in case of a medical emergency while traveling.

Deductibles are the amount you must pay out of pocket before the insurance coverage kicks in. Lower deductibles may result in higher premiums, but they can provide better financial protection in the event of a claim. Exclusions are specific situations or conditions that are not covered by the insurance policy.

It is vital to review the exclusions carefully to understand what is not covered and to avoid any surprises when making a claim.

Pre-Existing Medical Conditions Coverage

One crucial factor to consider when choosing travel insurance with health coverage is the inclusion of coverage for pre-existing medical conditions. If you have a pre-existing condition, it is essential to find a policy that offers coverage for related medical expenses during your trip.

Without this coverage, you may face significant out-of-pocket expenses if your pre-existing condition requires medical treatment while traveling. Be sure to disclose all pre-existing conditions when purchasing travel insurance to ensure you have the necessary coverage in place.

Top Providers Offering the Best Travel Insurance with Health Coverage

When it comes to choosing the best travel insurance with comprehensive health coverage, it is essential to consider reputable insurance providers that offer a range of benefits to ensure your well-being while traveling.

Allianz Global Assistance

- Allianz Global Assistance is a well-known insurance provider that offers travel insurance plans with comprehensive health coverage.

- Specific health coverage benefits include coverage for emergency medical expenses, medical evacuation, and repatriation.

- They also provide coverage for pre-existing conditions and offer 24/7 emergency assistance services for travelers in need.

AXA Assistance USA

- AXA Assistance USA is another top provider known for offering travel insurance plans with excellent health coverage benefits.

- Their plans include coverage for emergency medical treatment, hospital stays, and medical evacuation services.

- AXA Assistance USA also offers coverage for trip cancellations due to medical reasons and provides assistance in finding local medical facilities while traveling.

Travelex Insurance Services

- Travelex Insurance Services is a reputable insurance provider that offers travel insurance plans with comprehensive health coverage options.

- Their plans include coverage for emergency medical expenses, dental treatment, and emergency medical evacuation services.

- Travelex Insurance Services also provide coverage for trip interruptions due to medical emergencies and offer 24/7 travel assistance services.

Evaluating and Comparing Insurance Plans

- When evaluating and comparing different insurance plans, it is important to consider the specific health coverage benefits offered by each provider.

- Compare factors such as coverage limits, deductibles, exclusions, and additional services like emergency assistance and medical evacuation.

- Look for plans that cover a wide range of medical expenses, including emergency dental treatment, prescription medications, and coverage for pre-existing conditions.

Tips for Maximizing Benefits from Travel Insurance with Health Coverage

Travelers can maximize the benefits of their health coverage while abroad by following these tips:

Understand Your Policy

- Read through your travel insurance policy carefully to fully understand the coverage and benefits provided for medical expenses.

- Take note of any exclusions or limitations that may apply to your health coverage while traveling.

Carry Important Documents

- Always carry a copy of your travel insurance policy, emergency contact numbers, and any necessary medical documentation with you while traveling.

- Keep these documents easily accessible in case of an emergency.

Seek Pre-Approval

- If possible, seek pre-approval from your insurance provider before undergoing any medical treatment to ensure coverage for the expenses.

- Follow the procedures Artikeld by your insurance company for filing claims for medical expenses.

Keep Receipts

- Keep all receipts and documentation related to any medical expenses incurred during your trip.

- These receipts will be essential when filing a claim with your travel insurance provider.

Stay Informed

- Stay informed about the healthcare facilities and services available in the area you are traveling to.

- Be aware of any specific requirements or procedures that may affect your health coverage while abroad.

Real-Life Scenario

Imagine you fall ill while traveling abroad and require emergency medical treatment. Your travel insurance with health coverage comes to the rescue, covering all your medical expenses and providing assistance in arranging for your safe return home.

Ending Remarks

In conclusion, selecting the best travel insurance with health coverage can make all the difference in your travel experience. From maximizing benefits to understanding coverage options, being well-informed is key to a worry-free journey. Stay protected and travel with confidence!

Answers to Common Questions

What does health coverage in travel insurance typically include?

Health coverage in travel insurance usually includes medical emergencies, hospital stays, doctor visits, prescription medications, and sometimes even emergency medical evacuation.

Are pre-existing medical conditions covered in travel insurance with health coverage?

Some travel insurance plans offer coverage for pre-existing medical conditions, but it's essential to check the policy details and exclusions to ensure your specific condition is covered.

How can one maximize the benefits of travel insurance with health coverage?

To maximize benefits, travelers should familiarize themselves with their policy, keep copies of important documents, know how to reach the insurance provider in case of emergencies, and understand the claims process.