Delving into the realm of critical illness insurance with low deductibles opens up a world of financial protection and peace of mind. This type of insurance offers a safety net for unforeseen health challenges, ensuring that individuals are not burdened by high out-of-pocket costs.

Let's explore the intricacies of this unique insurance coverage and understand how it can benefit policyholders.

Introduction to Critical Illness Insurance with Low Deductibles

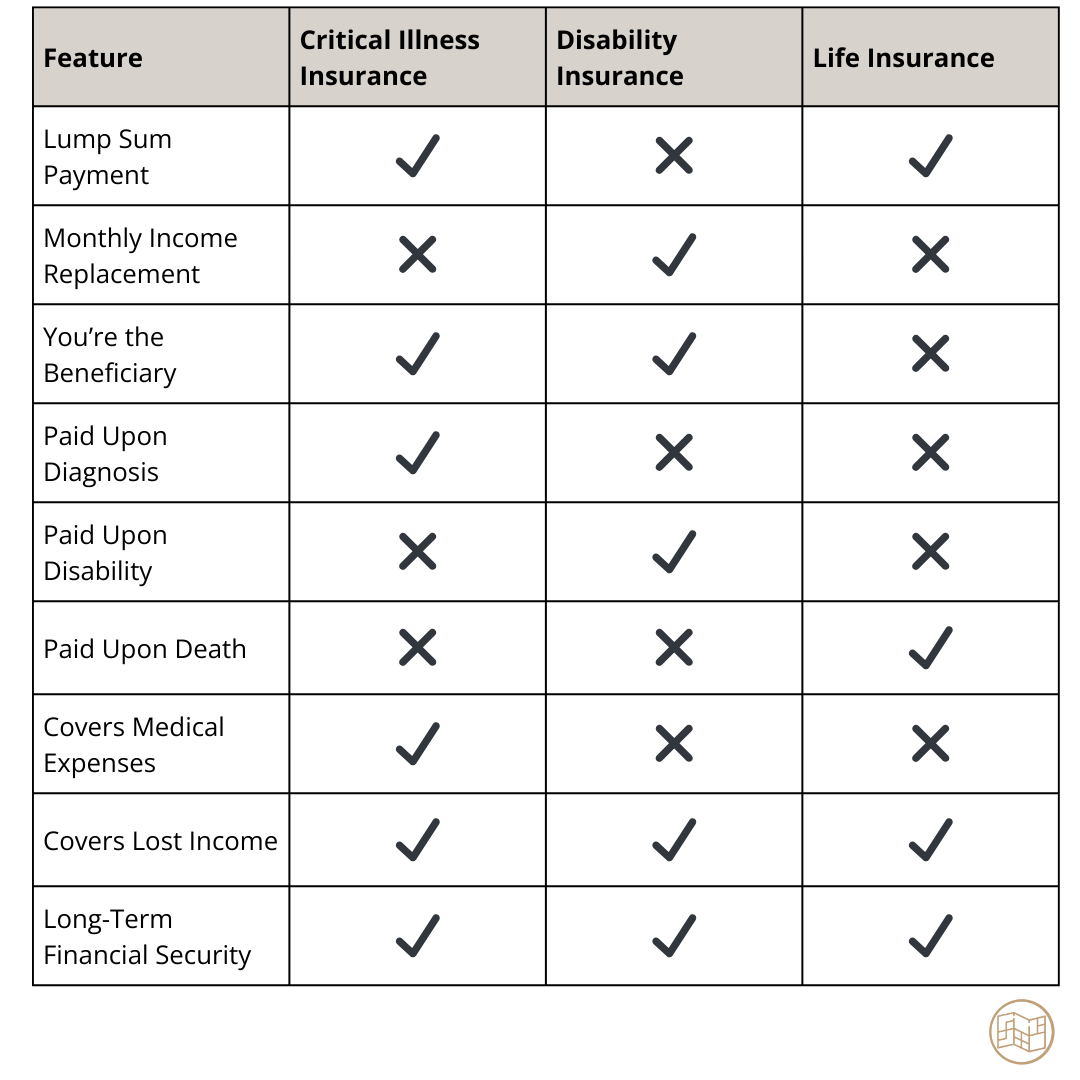

Critical illness insurance is a type of coverage that provides a lump-sum payment if the policyholder is diagnosed with a serious illness such as cancer, heart attack, or stroke. Unlike other types of insurance that may cover medical expenses or lost income, critical illness insurance is specifically designed to help cover the costs associated with a major health crisis.Low deductibles in critical illness insurance are crucial because they reduce the out-of-pocket expenses that the policyholder must pay before the insurance coverage kicks in.

This can be particularly important for individuals facing a significant medical diagnosis, as high deductibles could create a financial burden during an already stressful time.

Common Critical Illnesses Covered

- Cancer: Critical illness insurance often covers various types of cancer, including breast cancer, lung cancer, and prostate cancer.

- Heart Attack: This insurance typically includes coverage for heart attacks, which can require extensive medical treatment and rehabilitation.

- Stroke: Critical illness insurance commonly covers strokes, which can lead to long-term disability and require ongoing care.

- Organ Failure: Some policies also cover organ failures, such as kidney failure or liver failure, which may necessitate expensive treatments like dialysis or transplants.

Benefits of Critical Illness Insurance with Low Deductibles

Critical illness insurance with low deductibles offers several advantages that can greatly benefit policyholders. One of the key benefits is the impact on the affordability of premiums, making it more accessible for individuals to obtain coverage and protect themselves financially in case of a critical illness.

Lower Financial Burden

- Low deductibles in critical illness insurance reduce the out-of-pocket expenses that policyholders need to pay before the insurance coverage kicks in.

- This lower financial burden can make it easier for individuals to seek medical treatment promptly without worrying about the high costs associated with their illness.

- Policyholders are more likely to utilize their insurance benefits effectively and receive the necessary care without delay.

Increased Peace of Mind

- Having low deductibles in critical illness insurance provides policyholders with a sense of security and peace of mind knowing that they have coverage in place for potential medical emergencies.

- Policyholders can focus on their recovery and well-being without the added stress of significant financial obligations.

Enhanced Value for Premiums

- Low deductibles can increase the value of the premiums paid by policyholders, as they are more likely to receive immediate financial support when needed.

- Policyholders can feel assured that their insurance policy will provide substantial coverage without requiring a large upfront payment.

Coverage Details for Critical Illness Insurance with Low Deductibles

When it comes to critical illness insurance with low deductibles, policyholders can expect comprehensive coverage that provides financial protection in case of a serious illness diagnosis. Let's delve into the typical coverage included in policies with low deductibles, compare coverage options between low and high deductible plans, and discuss any limitations or exclusions that policyholders should be aware of.

Typical Coverage Included

- Hospitalization expenses

- Doctor's fees and consultations

- Prescription medications

- Medical tests and procedures

- Rehabilitation and therapy services

Comparison of Coverage Options

- Low Deductible Plans:Offer more comprehensive coverage with lower out-of-pocket costs for the policyholder.

- High Deductible Plans:Have lower monthly premiums but higher out-of-pocket costs when a claim is made.

- Differences:Low deductible plans provide better financial protection upfront, while high deductible plans may be more cost-effective for those who do not anticipate using the insurance frequently.

Limitations and Exclusions

- Certain pre-existing conditions may not be covered.

- Specific illnesses or treatments may be excluded from coverage.

- Policyholders should carefully review the policy documents to understand any limitations or exclusions before purchasing.

Factors to Consider When Choosing Critical Illness Insurance with Low Deductibles

When selecting a critical illness insurance policy with low deductibles, there are several key factors that individuals should consider to ensure they are making the right choice for their specific needs and circumstances. One of the most important factors to evaluate is how personal health history can influence the choice of deductible.

Additionally, it is crucial to carefully assess and compare different insurance providers offering low deductible options to find the best coverage for your situation.

Impact of Personal Health History on Deductible Choice

When choosing a critical illness insurance policy with low deductibles, individuals should take into account their personal health history. Those with a pre-existing medical condition or a family history of certain illnesses may benefit from opting for a lower deductible to ensure they can afford the out-of-pocket costs associated with a potential critical illness diagnosis.

On the other hand, individuals with a clean bill of health may feel comfortable selecting a higher deductible to reduce their premium costs.

Evaluating Different Insurance Providers Offering Low Deductible Options

To make an informed decision when choosing critical illness insurance with low deductibles, it is essential to evaluate and compare multiple insurance providers. Consider factors such as the reputation and financial stability of the insurance company, the range of coverage options available, the exclusions and limitations of the policy, as well as the premium costs and deductible amounts.

Look for insurance providers that have a strong track record of paying out claims promptly and provide excellent customer service to ensure you will have support when you need it most.

Case Studies and Real-Life Examples

In this section, we will explore case studies and real-life examples that highlight the benefits of low deductible critical illness insurance.

Case Study 1: John's Experience

- John, a 45-year-old individual, had a low deductible critical illness insurance policy.

- When he was diagnosed with a critical illness, his policy covered a significant portion of his medical expenses, including treatments and medications.

- Thanks to the low deductible, John did not have to worry about financial strain during his recovery period.

Case Study 2: Sarah's Story

- Sarah, a single mother of two, opted for low deductible critical illness insurance.

- When she was diagnosed with a critical illness, the insurance coverage helped her maintain her household and provide for her children.

- Having a low deductible ensured that Sarah could focus on her health and well-being without the added stress of financial burdens.

Testimonials

"I am grateful for my low deductible critical illness insurance policy. It provided me with the financial support I needed during a challenging time."

Jane

"Having low deductible coverage made a significant difference in my recovery journey. I highly recommend it to anyone considering critical illness insurance."

Mark

Final Review

In conclusion, critical illness insurance with low deductibles provides a valuable layer of financial security against unexpected health crises. By opting for low deductibles, individuals can safeguard their savings and focus on recovery without worrying about exorbitant medical expenses. It's essential to weigh the benefits and coverage details carefully when considering this type of insurance to make an informed decision that aligns with your healthcare needs.

Q&A

Are pre-existing conditions covered under critical illness insurance with low deductibles?

Typically, pre-existing conditions are not covered under critical illness insurance. It's essential to review the policy details to understand any specific inclusions or exclusions.

Can I customize the coverage options in a critical illness insurance policy with low deductibles?

Some insurance providers may offer customization options for coverage within certain limits. It's advisable to inquire with the insurance company about any available customization features.

What happens if I miss a premium payment for my critical illness insurance with low deductibles?

Missing a premium payment can result in a lapse of coverage. It's crucial to stay up to date with premium payments to ensure continuous protection under the policy.