Embark on a journey through the world of health insurance for digital nomads in Europe. Discover the unique needs of nomads, the challenges they face, and the importance of having proper coverage while living a life on the move.

Explore the various types of health insurance available, factors to consider when choosing a plan, and the legal and regulatory considerations that come into play for digital nomads in Europe.

Overview of Health Insurance for Digital Nomads in Europe

As digital nomads, individuals who work remotely and travel frequently face unique challenges when it comes to obtaining suitable health insurance coverage while living in Europe.

Define Digital Nomads and Their Unique Insurance Needs

Digital nomads are individuals who leverage technology to work remotely and have the flexibility to travel and live in different locations. Their lifestyle requires health insurance that provides coverage across multiple countries, offering flexibility and access to medical care wherever they may be.

Importance of Having Health Insurance While Living a Nomadic Lifestyle

Having health insurance is crucial for digital nomads as they navigate different healthcare systems and face uncertainties while living and working in various countries. Health insurance provides financial protection in case of unexpected medical emergencies, ensuring that digital nomads can access necessary healthcare services without worrying about high costs.

Challenges Digital Nomads Face in Obtaining Suitable Health Coverage

One of the main challenges digital nomads encounter is finding health insurance plans that offer coverage across multiple countries and meet their specific needs. Limited options, high costs, and complex regulations in different countries can make it difficult for digital nomads to secure comprehensive health insurance that aligns with their nomadic lifestyle.

Types of Health Insurance Available for Digital Nomads in Europe

When it comes to health insurance options for digital nomads in Europe, there are several choices to consider. Let's compare and contrast private health insurance with public health insurance, explain the differences between travel insurance, international health insurance, and expat insurance, and provide examples of insurance providers that cater specifically to digital nomads in Europe.

Private Health Insurance vs. Public Health Insurance

Private health insurance typically offers more comprehensive coverage and flexibility compared to public health insurance. While public health insurance is often more affordable and mandatory in some European countries, it may come with limitations in terms of services and providers.

Travel Insurance, International Health Insurance, and Expat Insurance

Travel insurance is designed to cover medical emergencies and travel-related incidents for a short period, usually during trips. International health insurance provides broader coverage for longer stays abroad, including regular medical check-ups and treatments. Expat insurance is tailored for individuals living abroad for an extended period, offering comprehensive health coverage in their host country.

Insurance Providers for Digital Nomads in Europe

- SafetyWing:Known for their flexible and affordable health insurance plans specifically designed for digital nomads.

- Cigna Global:Offers international health insurance with extensive coverage options for expats and digital nomads living in Europe.

- Allianz Care:Provides customizable health insurance plans for individuals living and working abroad, including coverage in European countries.

Factors to Consider When Choosing Health Insurance as a Digital Nomad in Europe

When selecting health insurance as a digital nomad in Europe, there are several key factors to take into consideration to ensure you have adequate coverage and peace of mind during your travels.

Coverage Area, Cost, Deductibles, and Benefits

- Consider the coverage area of the health insurance plan to ensure it includes the countries you plan to visit or reside in.

- Compare the costs of different insurance plans, taking into account monthly premiums, deductibles, and out-of-pocket expenses.

- Examine the benefits offered by each plan, such as coverage for routine check-ups, hospital stays, emergency services, and prescriptions.

Pre-existing Conditions and Coverage for Emergency Situations

- It is essential to disclose any pre-existing conditions when purchasing health insurance to avoid complications with coverage later on.

- Ensure that the insurance plan covers emergency medical situations, including ambulance services, hospitalization, and repatriation if needed.

- Check if there are any restrictions or limitations on coverage for pre-existing conditions or emergency care.

Telemedicine Services and Digital Access to Healthcare Providers

- Look for health insurance plans that offer telemedicine services, allowing you to consult with healthcare professionals remotely for non-emergency medical issues.

- Consider the availability of digital access to healthcare providers in the countries you plan to visit, as this can be convenient for seeking medical advice or prescriptions while on the go.

- Evaluate the ease of communication and coordination with healthcare providers through digital platforms, ensuring you can access care when needed, no matter where you are.

Legal and Regulatory Considerations for Health Insurance in Europe

When it comes to health insurance for digital nomads in Europe, there are several legal and regulatory considerations to keep in mind to ensure you have adequate coverage while traveling and working abroad.

Schengen Visa Requirements for Health Insurance Coverage

If you are a digital nomad planning to travel within the Schengen area, it is essential to have health insurance coverage that meets the Schengen visa requirements. The Schengen visa requires travelers to have health insurance with a minimum coverage of €30,000 for medical emergencies, hospital treatment, and repatriation.

Make sure to check the specific requirements of the Schengen country you plan to visit to ensure you meet the necessary health insurance criteria.

Impact of Brexit on Health Insurance Regulations for UK Digital Nomads in Europe

Following Brexit, UK digital nomads may face changes in health insurance regulations when traveling to Europe. While the European Health Insurance Card (EHIC) used to provide UK residents with access to state-provided healthcare during temporary stays in EU countries, the EHIC is no longer valid for UK residents.

As a result, UK digital nomads may need to secure private health insurance or ensure they have adequate coverage before traveling to Europe to avoid any potential healthcare costs.

European Health Insurance Card (EHIC) and its Relevance for Digital Nomads

The European Health Insurance Card (EHIC) allows EU citizens to access necessary healthcare services during temporary stays in other EU/EEA countries or Switzerland. While the EHIC is not a substitute for travel insurance, it provides coverage for essential medical treatment at reduced costs or for free.

Digital nomads from EU/EEA countries can benefit from the EHIC when traveling within the European Union, ensuring access to healthcare services in case of emergencies or unexpected medical needs.

Epilogue

As we conclude this discussion on health insurance for digital nomads in Europe, remember the key points discussed. Make informed decisions to ensure your well-being while navigating the nomadic lifestyle in Europe.

FAQ Insights

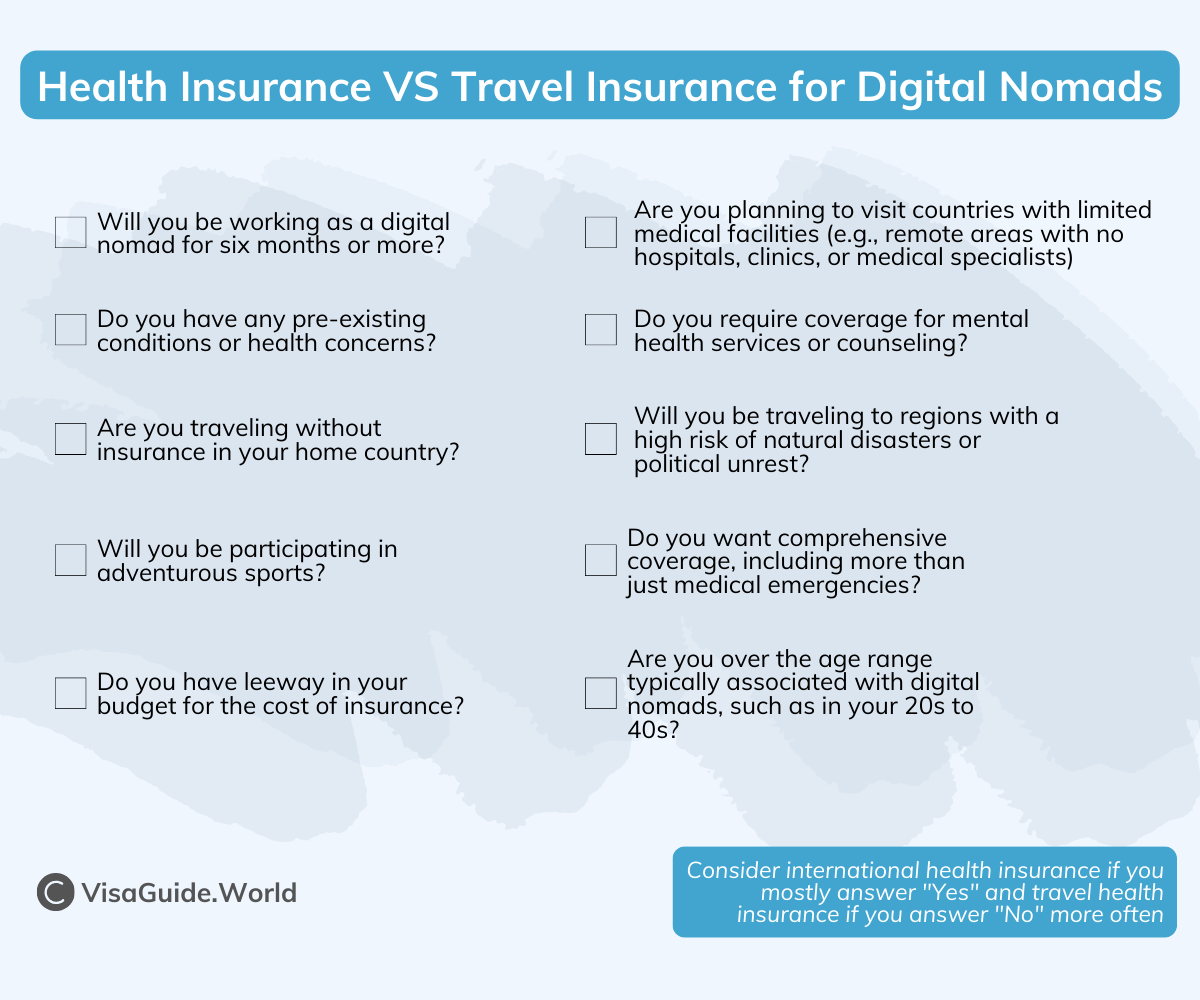

Is travel insurance the same as international health insurance?

Travel insurance typically covers short trips and may have limited health coverage, while international health insurance provides more comprehensive coverage for longer stays abroad.

What are some insurance providers that cater specifically to digital nomads in Europe?

Some insurance providers that cater to digital nomads in Europe include SafetyWing, World Nomads, and Cigna Global.

How has Brexit affected health insurance regulations for UK digital nomads in Europe?

Post-Brexit, UK digital nomads may need to ensure they have appropriate health insurance to cover them while traveling in Europe, as they may no longer benefit from reciprocal healthcare agreements.