Navigating the world of health insurance premiums can be daunting, but with the right information and guidance, comparing different plans becomes more manageable. From understanding the various factors influencing premium costs to making informed decisions, this guide will help you make the best choice for your healthcare needs.

Factors to Consider When Comparing Health Insurance Premiums

When comparing health insurance premiums, it is essential to consider various factors that can impact the cost and coverage of the plan. By understanding these factors, you can make an informed decision that suits your healthcare needs and budget.

Types of Health Insurance Plans

There are different types of health insurance plans available, including:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

Each plan has its own network of healthcare providers and coverage options, affecting the premium costs and out-of-pocket expenses.

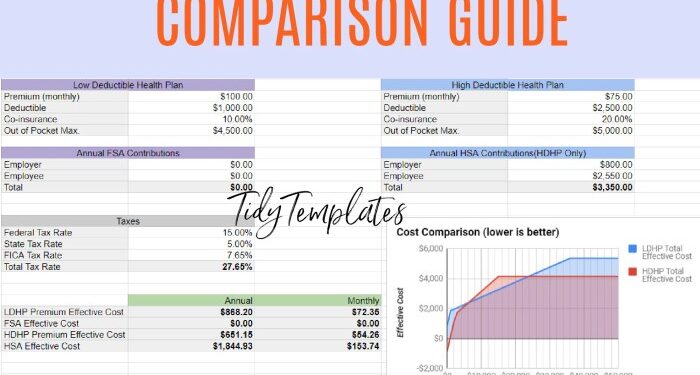

Significance of Comparing Premiums

Comparing premiums allows you to assess the cost of different health insurance plans and choose one that offers the best value for your needs. It helps you understand the trade-off between monthly premiums and out-of-pocket costs, enabling you to select a plan that balances affordability and coverage effectively.

Coverage Levels Impact on Premium Costs

The coverage levels offered by health insurance plans impact premium costs significantly. Plans with comprehensive coverage, including services like prescription drugs, mental health care, and maternity care, tend to have higher premiums. On the other hand, basic plans with limited coverage may have lower premiums but higher out-of-pocket expenses when seeking healthcare services.

Deductibles and Copayments Influence Premium Prices

Deductibles and copayments are key factors that influence premium prices. Plans with higher deductibles and copayments typically have lower premiums, making them more affordable for individuals who don't require frequent medical care. However, it's essential to consider your healthcare needs and budget when choosing a plan with higher deductibles and copayments, as they can result in higher out-of-pocket costs when seeking medical treatment.

Methods for Comparing Health Insurance Premiums

When it comes to comparing health insurance premiums, there are several methods you can use to ensure you are getting the best deal for your needs. From utilizing online tools to reviewing benefits along with premium prices, here is a step-by-step guide on how to compare premium costs effectively.

Using Online Tools to Compare Health Insurance Premiums

- Start by visiting reputable insurance comparison websites or the official websites of insurance providers.

- Enter your personal information, including age, location, and coverage needs, to receive accurate quotes.

- Compare the premium costs offered by different insurance companies side by side to see which one offers the best value for money.

- Take note of any additional benefits or coverage options provided by each insurer to make an informed decision.

Reviewing Benefits Along with Premium Prices

- Do not solely focus on the premium price; consider the benefits and coverage offered by each insurance plan.

- Look at factors such as deductibles, co-pays, network coverage, and out-of-pocket maximums to understand the overall value of the plan.

- Ensure that the insurance plan covers the services and treatments you need, such as prescription drugs, preventive care, and specialist visits.

- Compare the quality of customer service and satisfaction ratings of different insurance providers to gauge their reliability.

Obtaining Quotes from Multiple Insurance Providers

- Contact insurance companies directly or use online platforms to request quotes from multiple providers simultaneously.

- Provide accurate information about your health history, lifestyle habits, and coverage preferences to receive tailored quotes.

- Compare the quotes received, paying attention to any discrepancies or hidden costs that may impact the overall affordability of the plan.

- Consider reaching out to insurance agents or brokers for personalized advice on choosing the right health insurance plan for your needs.

Understanding the Cost vs. Coverage Trade-off

When comparing health insurance premiums, it's crucial to consider the trade-off between cost and coverage. This trade-off refers to the balance between the amount you pay in premiums and the extent of coverage you receive in return.

Scenarios where lower premiums may mean less coverage

- High deductibles and copayments: Plans with lower premiums often come with higher out-of-pocket costs, such as deductibles and copayments. While the monthly premium may be affordable, you may end up paying more when you need medical services.

- Limited network of providers: Some low-cost plans restrict you to a smaller network of healthcare providers, limiting your options for quality care.

- Reduced benefits: Lower premium plans may offer limited coverage for essential services, preventive care, or prescription drugs.

Striking a balance between cost and coverage based on individual needs

- Assess your healthcare needs: Consider your current health status, any ongoing medical conditions, and the frequency of medical services you anticipate needing.

- Compare plan options: Evaluate different plans based on their premiums, deductibles, copayments, and coverage for services that are important to you.

- Consider your budget: Determine how much you can afford to pay in premiums and out-of-pocket costs without compromising your financial stability.

Benefits of high vs. low deductible plans in relation to premium costs

- High deductible plans: These plans typically have lower premiums but require you to pay more out-of-pocket before insurance coverage kicks in. They can be cost-effective for healthy individuals who don't expect to use many medical services.

- Low deductible plans: While these plans come with higher premiums, they offer lower out-of-pocket costs when you need medical care. They are suitable for individuals with chronic conditions or frequent healthcare needs.

Key Tips for Making Informed Decisions

When it comes to choosing the right health insurance plan, being well-informed is crucial. Here are some key tips to help you make informed decisions:

Reading and Understanding Health Insurance Policy Documents

Before signing up for a health insurance plan, it is essential to thoroughly read and understand the policy documents. Pay attention to details such as coverage limits, exclusions, copayments, and deductibles. If you have any questions or uncertainties, don't hesitate to reach out to the insurance provider for clarification.

Considering Network Coverage

When comparing health insurance premiums, it's important to consider network coverage. Make sure that the plan you choose includes healthcare providers and facilities that are convenient for you to access. Out-of-network care can be significantly more expensive, so choosing a plan with a broad network can save you money in the long run.

Evaluating the Reputation and Reliability of Insurance Providers

Before committing to a health insurance plan, take the time to research and evaluate the reputation and reliability of the insurance providers. Look into factors such as the company's financial stability, customer service record, and claim settlement efficiency. Choosing a reputable and reliable insurance provider can give you peace of mind knowing that you are covered by a trustworthy company.

Role of Customer Reviews and Ratings

Customer reviews and ratings can provide valuable insights into the quality of service offered by insurance providers. Take the time to read reviews from current and past policyholders to get a sense of their experiences. Pay attention to feedback on claim processing, customer support, and overall satisfaction.

Incorporating customer reviews and ratings into your decision-making process can help you choose a health insurance plan that aligns with your needs and expectations.

Closing Summary

In conclusion, knowing how to compare health insurance premiums empowers you to make a well-informed decision that aligns with your budget and coverage requirements. By following the tips and methods Artikeld here, you can navigate the complexities of health insurance with confidence.

Expert Answers

What are the different types of health insurance plans available?

Health insurance plans can include HMOs, PPOs, EPOs, and POS plans, each with varying levels of coverage and provider networks.

How can I compare premium costs effectively?

To compare premium costs, gather quotes from multiple insurance providers, review benefits offered, and consider your healthcare needs.

Why is it important to consider network coverage when comparing premiums?

Network coverage ensures that you can access healthcare services from a wide range of providers without incurring hefty out-of-network costs.

How do deductibles and copayments influence premium prices?

Higher deductibles and copayments usually result in lower premium costs, but they can lead to higher out-of-pocket expenses when seeking medical care.