Delving into the realm of Life and health insurance bundle options, this introduction aims to intrigue and inform the audience about the advantages and considerations of bundling these essential coverages.

Detailing the various aspects of bundled insurance and how it differs from individual policies, the subsequent paragraph sets the stage for a comprehensive discussion.

Overview of Life and Health Insurance Bundle Options

When it comes to insurance coverage, bundling life and health insurance can offer a comprehensive solution for individuals and families. This approach involves combining both life insurance, which provides financial protection in case of death, and health insurance, which covers medical expenses, into a single package.

Opting for a bundle of life and health insurance can provide several benefits compared to purchasing separate policies:

Cost-Effectiveness

One of the primary advantages of choosing a bundled insurance option is the potential cost savings. Insurance companies often offer discounts when multiple policies are purchased together. This can result in lower premiums overall compared to buying individual life and health insurance policies separately.

Types of Coverage Offered in Bundle Options

When it comes to life and health insurance bundle options, there are various types of coverage available to meet different needs and preferences.

Life Insurance Coverage

- Term Life Insurance: Provides coverage for a specific period of time and pays out a death benefit if the insured passes away during the term.

- Whole Life Insurance: Offers coverage for the entire life of the insured and includes a cash value component that grows over time.

- Universal Life Insurance: Combines a death benefit with a savings component that earns interest at a variable rate.

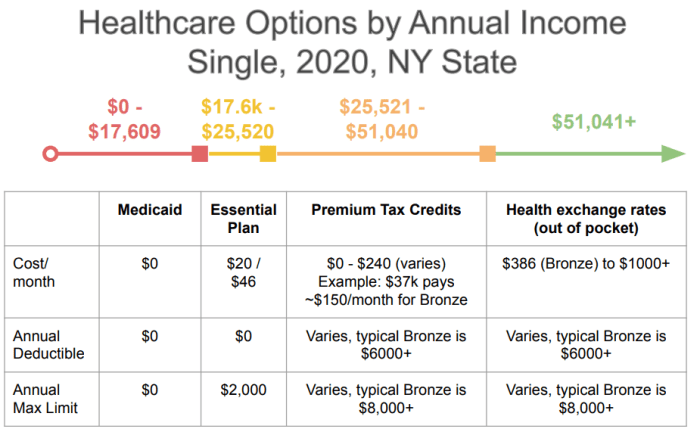

Health Insurance Options

- Health Maintenance Organization (HMO): Requires individuals to choose a primary care physician and obtain referrals for specialists.

- Preferred Provider Organization (PPO): Allows individuals to visit any healthcare provider, but offers lower costs for in-network services.

- High Deductible Health Plan (HDHP): Features lower monthly premiums but higher deductibles, often paired with a Health Savings Account (HSA).

Add-ons and Riders

- Accidental Death Benefit Rider: Provides an additional death benefit if the insured passes away due to an accident.

- Disability Income Rider: Offers a source of income if the insured becomes disabled and unable to work.

- Critical Illness Rider: Pays out a lump sum benefit upon diagnosis of a serious illness like cancer or heart disease.

Considerations Before Choosing a Bundle

When evaluating life and health insurance bundles, there are several key factors that should be taken into consideration to ensure you select the right option that meets your needs and circumstances.Understanding your individual needs and circumstances is crucial when choosing a bundle.

Factors such as your age, health condition, financial situation, and future plans should all be taken into account. For example, if you have a pre-existing medical condition, you may need a health insurance policy with specific coverage that addresses your needs.It is important to thoroughly understand the policy terms, coverage limits, and exclusions of the bundle options you are considering.

Policy terms can vary greatly between insurance providers, so make sure you are aware of what is covered and what is not. Additionally, pay attention to coverage limits to ensure they align with your expected healthcare and financial needs. Exclusions are also important to note, as they can impact the benefits you receive from the policy.

Factors to Consider When Evaluating Life and Health Insurance Bundles

- Monthly Premium Costs: Compare the costs of different bundles to ensure they fit within your budget.

- Network Coverage: Check if your preferred healthcare providers are included in the insurance network.

- Policy Flexibility: Look for bundles that offer flexibility in coverage options and the ability to adjust the policy as needed.

- Customer Service: Research the reputation of the insurance provider for customer service and claims processing.

Customization and Flexibility in Bundle Options

When it comes to life and health insurance bundle options, insurance companies often provide policyholders with the flexibility to customize their coverage to meet their specific needs. This customization allows individuals to tailor their bundle according to their unique requirements and preferences.

Customizing Bundle Components

- Policyholders can choose the specific types of coverage they want to include in their bundle, such as term life insurance, critical illness coverage, dental insurance, or vision insurance.

- Insurance companies may also offer add-on options that policyholders can select to enhance their bundle, such as accidental death coverage or disability insurance.

- Customers can adjust the coverage levels for each component within the bundle to ensure they have adequate protection in areas that are most important to them.

- Some insurance providers even offer the option to mix and match different types of coverage to create a customized bundle that aligns with the policyholder's lifestyle and budget.

Ultimate Conclusion

In conclusion, the exploration of Life and health insurance bundle options sheds light on the customizable nature of these packages and the importance of tailoring them to fit individual needs.

User Queries

What are the advantages of bundling life and health insurance?

By combining these policies, individuals can often save on premiums and enjoy streamlined coverage management.

Can I customize my bundle components?

Insurance companies typically offer flexibility in adjusting coverage levels to suit specific requirements.

How should individual needs influence bundle selection?

It's crucial to consider personal circumstances and coverage requirements when choosing a bundled insurance plan.