Exploring the realm of senior citizen health insurance in the US and EU unveils a landscape of crucial differences and similarities. This overview delves into the intricacies of healthcare coverage for older adults, shedding light on the importance of this topic in today's society.

As we navigate through the nuances of health insurance for seniors, we uncover a tapestry of essential information that shapes the way older individuals access and utilize healthcare services in different parts of the world.

Overview of Senior Citizen Health Insurance

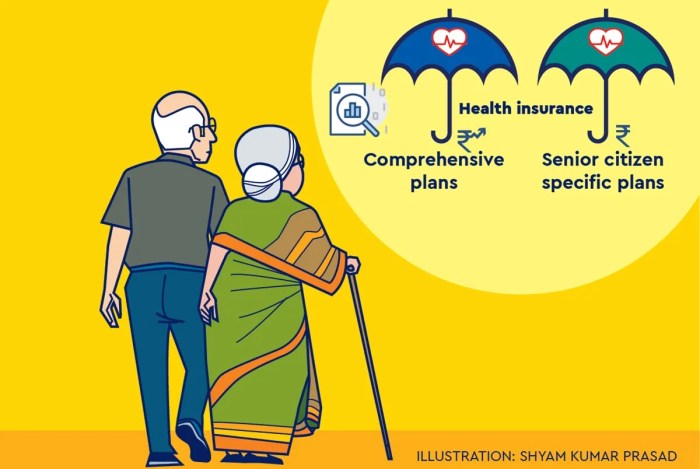

Senior citizen health insurance is a type of insurance specifically designed to cater to the healthcare needs of individuals who are aged 65 and older. It helps cover medical expenses such as hospitalization, prescription drugs, doctor visits, and other healthcare services that seniors may require.

Having health insurance is crucial for seniors as they are more susceptible to health issues due to age-related factors. It provides financial protection and ensures access to necessary healthcare services without the burden of high out-of-pocket costs.

Key Differences between US and EU Senior Citizen Health Insurance

- In the US, senior citizens are eligible for Medicare, a federal health insurance program primarily for those aged 65 and older. It consists of different parts covering various healthcare services. In contrast, the EU countries have a mix of public and private healthcare systems, with varying coverage and eligibility criteria for seniors.

- Medicare in the US is funded by the government through payroll taxes and premiums, while the EU healthcare systems are largely funded through taxation. This difference in funding mechanisms can impact the level of coverage and services available to seniors in each region.

- There are also differences in the cost-sharing arrangements between the US and EU senior citizen health insurance. In the US, Medicare beneficiaries may have deductibles, copayments, and coinsurance, while some EU countries offer more comprehensive coverage with minimal out-of-pocket expenses for seniors.

- Moreover, the availability of supplementary or private health insurance options for seniors varies between the US and EU. In the US, seniors can purchase additional private insurance to supplement their Medicare coverage, while in the EU, supplementary insurance may be less common due to the comprehensive nature of public healthcare systems.

Senior Citizen Health Insurance Coverage

Senior citizen health insurance coverage plays a crucial role in ensuring that older adults have access to necessary medical services and treatments. It provides financial protection and peace of mind for seniors as they navigate various healthcare needs.

Common Types of Coverage

Senior citizen health insurance typically includes the following common types of coverage:

- Hospitalization: Covers expenses related to hospital stays, surgeries, and other inpatient services.

- Outpatient Care: Includes coverage for doctor visits, diagnostic tests, and outpatient procedures.

- Prescription Drugs: Helps offset the cost of medications prescribed by healthcare providers.

- Preventive Services: Covers preventive care such as screenings, vaccinations, and wellness visits.

- Mental Health Services: Provides coverage for mental health counseling and therapy sessions.

Comparison of Coverage Options in US and EU

Senior citizens in the US and EU may have different coverage options available to them. In the US, Medicare is the primary health insurance program for individuals aged 65 and older, while private insurance companies offer supplemental plans. In the EU, healthcare systems vary by country, with many providing universal coverage through national health services.

Significance of Comprehensive Coverage

Comprehensive coverage is essential for older adults as it ensures they have access to a wide range of medical services without facing significant out-of-pocket costs. It helps seniors manage chronic conditions, receive timely treatments, and maintain overall health and well-being.

Having comprehensive coverage can also reduce stress and financial burden for both seniors and their families.

Cost Considerations

When it comes to senior citizen health insurance, the cost is a significant factor that needs to be carefully considered. Various factors influence the cost of health insurance for seniors, and understanding these can help in making informed decisions. Additionally, there are specific cost-saving measures that seniors can take advantage of to ensure they have access to affordable health insurance.

Let's explore the cost considerations for senior citizen health insurance in the US and EU.

Factors Influencing Cost

- The age of the individual: Older individuals typically face higher health insurance premiums due to increased health risks.

- Health condition: Pre-existing medical conditions may result in higher premiums or exclusions from coverage.

- Location: The cost of healthcare services and insurance varies by region, impacting the overall cost of health insurance.

- Type of coverage: The level of coverage and benefits included in the insurance plan can affect the cost.

Cost-Saving Measures for Seniors

- Comparing different insurance plans: Seniors should explore multiple insurance providers to find the most cost-effective option.

- Utilizing discounts: Some insurers offer discounts for seniors, which can help reduce the overall cost of health insurance.

- Participating in wellness programs: Engaging in preventive health measures can lead to lower healthcare costs in the long run.

Affordability in the US and EU

In the US, the cost of senior citizen health insurance can be higher compared to the EU due to the private insurance market and healthcare system. However, in the EU, social health insurance systems and universal coverage options often make health insurance more affordable for seniors.

It is essential for seniors to carefully evaluate their options and consider their individual healthcare needs when choosing a health insurance plan in either region.

Access to Healthcare Services

Senior citizen health insurance plays a crucial role in determining the access to healthcare services for elderly individuals. It provides them with financial coverage for medical treatments, doctor visits, prescription medications, and preventive care, ensuring that they can seek necessary healthcare without facing significant financial burden.

Impact of Senior Citizen Health Insurance

- Ensures Affordability: Health insurance enables seniors to afford essential healthcare services that they may otherwise struggle to pay for out of pocket.

- Promotes Regular Check-ups: With insurance coverage, seniors are more likely to schedule regular check-ups and screenings, leading to early detection of health issues.

- Access to Specialists: Insurance plans often include access to specialist care, allowing seniors to receive treatment from healthcare providers with expertise in their specific health conditions.

Limitations and Challenges

- Out-of-Pocket Costs: Despite having insurance, seniors may still face high out-of-pocket costs such as copayments, deductibles, and coinsurance, which can deter them from seeking necessary care.

- Provider Networks: Some insurance plans have limited provider networks, making it challenging for seniors to access healthcare services from their preferred doctors or hospitals.

- Complexity of Coverage: Understanding the coverage details, including what services are included and excluded, can be confusing for seniors, leading to potential misunderstandings and gaps in care.

Differences in Healthcare Service Access

In the United States, access to healthcare services for seniors can be influenced by factors such as insurance coverage, affordability, and geographic location. The complex healthcare system in the US can sometimes create barriers to accessing timely and affordable care for elderly individuals.

On the other hand, in the European Union, many member countries have universal healthcare systems that provide comprehensive coverage to all citizens, including seniors. This often results in better access to healthcare services, lower out-of-pocket costs, and a greater emphasis on preventive care and wellness programs for the elderly population.

Special Considerations for Seniors

As seniors age, they often face specific healthcare needs that require special attention to ensure their well-being. Preventive care and wellness programs play a crucial role in maintaining the health and quality of life of aging individuals. Health insurance plans tailored to the unique requirements of older adults are essential in providing comprehensive coverage for their medical needs.

Specific Healthcare Needs for Seniors

Seniors may require regular screenings and tests to monitor chronic conditions such as diabetes, high blood pressure, and osteoporosis. Additionally, they may need access to specialists such as geriatricians, who are trained to address the complex health issues that come with aging.

Importance of Preventive Care and Wellness Programs

Preventive care, including vaccinations, screenings, and health assessments, can help seniors detect and manage health issues early on, preventing more serious complications. Wellness programs that promote physical activity, healthy eating, and mental well-being are crucial for maintaining overall health in older adults.

Health Insurance Plans for Older Adults

Health insurance plans for seniors often include coverage for preventive services, prescription medications, and long-term care. Some plans may also offer benefits such as telehealth services, home healthcare, and vision and dental care, recognizing the unique needs of older individuals.

Last Recap

In conclusion, the journey through the realm of senior citizen health insurance in the US and EU has provided valuable insights into the complexities and challenges faced by older adults in securing adequate healthcare coverage. By understanding the nuances of this topic, we can strive to create a better future for seniors in terms of health and well-being.

Top FAQs

What are the key differences between health insurance for seniors in the US and EU?

The main differences lie in the healthcare systems, coverage options, and affordability structures between the two regions.

What factors influence the cost of senior citizen health insurance?

Factors such as age, pre-existing conditions, chosen coverage options, and geographic location can impact the cost of health insurance for seniors.

How do health insurance plans cater to the unique requirements of older adults?

Health insurance plans for seniors often include coverage for specific healthcare needs such as chronic conditions, preventive care, and wellness programs tailored to aging individuals.